what taxes do i pay after retirement

Discover Which Retirement Options Align with Your Financial Needs. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar retirement plans and tax.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

In 2022 the long-term capital gains tax rate is 0.

. Investment returns on TTR pensions are taxed at up to 15 the same as a super. However there are narrow exceptions to. I am working as a teacher at a public.

Social Security will withhold benefits at the following rates in 2021. August 26 2022 Taxes. What is the tax rate on 401k withdrawals after retirement.

1 for every 2 of earned income above 18960 until the year you reach full retirement age. For retirees who begin receiving pension payments before age 55. This 401 k tax-deferred status means that if you put in the 2021 maximum of 19500 in 2021 but your income for the year is 100000 youll pay taxes on 80500 for this.

There is a mandatory withholding of 20 of a 401 k withdrawal to cover federal income tax whether you will. Even with the federal exemption from death taxes raised retirees should pay more attention to estate taxes and inheritance taxes levied by states. Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes.

Fisher Investments shares these 7 retirement income strategies to help you in retirement. If you make 80000 a year living in the region of California USA you will be taxed 22222. Ad Download The Definitive Guide to Retirement Income from Fisher Investments.

This is a 38 Medicare surtax that applies to net. In keeping with a promise he originally made back in 2020 Biden plans to forgive up to 10000 of federal student loans for borrowers who make less than 125000 annually. Ad Download The Definitive Guide to Retirement Income from Fisher Investments.

Ad Experienced Support Exceptional Value Award-Winning Education. You wont be charged taxes on the part of the payment that represents the after-tax portion you paid in. Open an Account Today.

Deductible tax can be a consideration in. What taxes do retirees have to pay. Taxation varies depending on the type of retirement income you receive.

How Much Tax Do I Pay - The term net of tax refers to the amount remaining after adjusting for the effects of taxes. Your 401 k contributions are deducted from your paycheck much before the IRS takes its cut. Access Insights On Retirement Concerns The Impact Of Taxes.

1 day agoOther people might find that lower income one year reduces their long-term capital gains rate below 20 to 15 or even 0. A retired teachers explores the best way to avoid paying unnecessary tax on his retirement. Ad Find Out Why Tax Diversification is Important.

Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. You pay the same amount of tax as on other super income streams according to your age. What is the federal tax rate on 80000.

That means that your net pay will be. You may pay taxes on Social Security benefits if you have other sources of income. Under current law for 2018 the.

Finally depending on your income you might have to pay the Net Investment Income Tax NIIT after you retire. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401ks 403bs and. Unlike certain types of income such as qualified dividends or long-term capital gains no special tax treatment is available for pension income.

For example if your monthly paycheck is 2000 before taxes and you contribute 500 to your. TD Ameritrade Offers IRA Plans With Flexible Contribution Options. Fisher Investments shares these 7 retirement income strategies to help you in retirement.

3 Tax Friendly States For Senior Retirement Tax Seniors Retirement

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

Taxes By State Retirement Living Information Center Retirement Living Retirement Money Retirement

Top 3 Benefits Of Roth Ira Individual Retirement Account

State By State Guide To Taxes On Retirees Retirement Retirement Income Tax

Savvy Tax Withdrawals Fidelity Financial Fitness Tax Traditional Ira

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Roth Ira Conversion After 50 Fidelity Investments Roth Ira Conversion Roth Ira Roth

States That Don T Tax Social Security Benefits Social Security Benefits Social Security Social

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

What To Do With A 401k After Retiring From Your Employer Investing For Retirement Retirement Advice Retirement Strategies

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

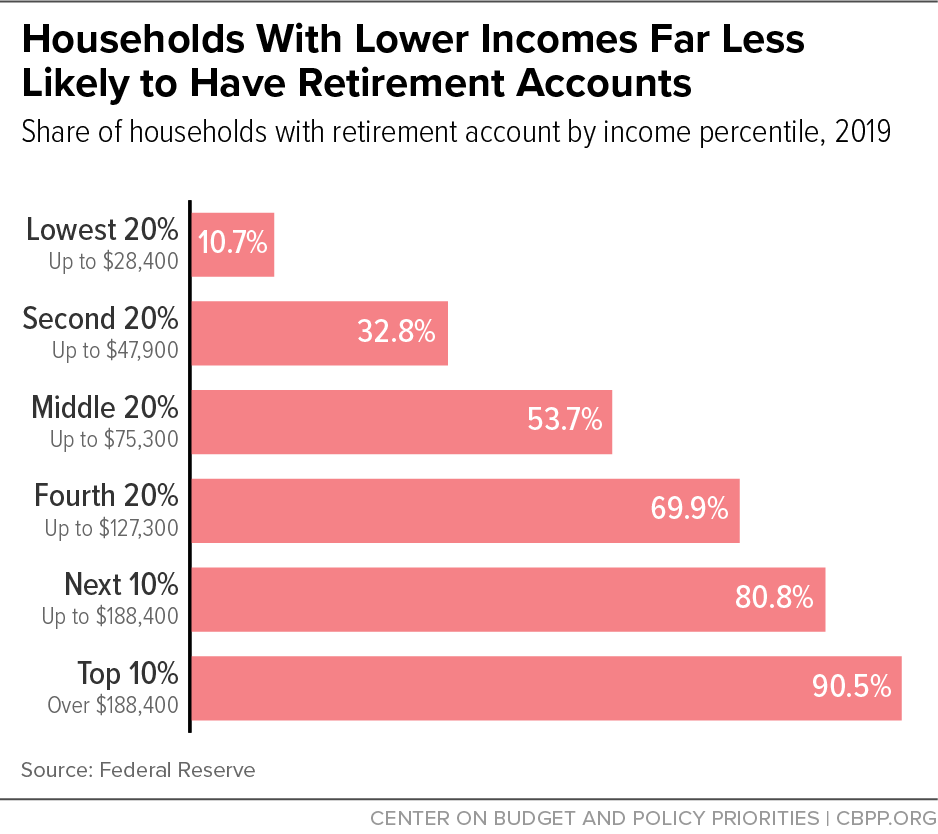

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Vanguard Consider The Advantages Of Roth After Tax Contributions

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

The Best Retirement Vehicle You Ve Never Heard Of Www Americanwealthonline Com Ratho Reis Manager Ratho Awg Gma How To Plan Retirement Planning Retirement

If You Re Already Contributing The Irs Maximum Amount To Your 401 K And Would Like To Keep Reap Saving For Retirement Finance Saving Personal Finance Bloggers

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)